Key Points

- CEO Elon Musk’s latest stock sale does not impact the company’s growth plans.

- Tesla expects strong growth in its vehicle deliveries in the coming years.

- Full self-driving is a key future growth opportunity for Tesla.

Electric vehicle (EV) maker Tesla management made headlines (again!) last week after CEO Elon Musk conducted a poll about whether he should sell 10% of his Tesla stock. Following the poll’s results, Musk sold around $5 billion of the stock (which works out to around 2.6% of his holdings after exercising options) on Wednesday. Long-time followers of Tesla stock have often seen its price fluctuating wildly on news announcements, or Musk’s tweets, along these lines.

Musk’s latest stock sale did have some small effect on the stock price short-term, but it may not impact Tesla in any significant way in the long run, say 10 years down the road. Even after the sale, the company’s founder will still own a high percentage of his previous stake. The main reason for the sale is to get the cash to pay the taxes Musk owes because he exercised stock option trades that were about to expire.

So by itself, there isn’t too important to read into this rearmost move, and the company’s long-term growth plans remain where complete. What are those growth plans? And how might they affect the stock in the future? Let’s take a near look at Tesla’s growth eventuality in the coming decade, and beyond.

Tesla’s growth plans

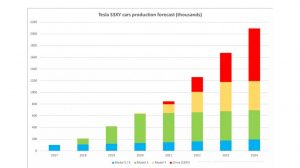

In the third quarter, Tesla’s profit grew 57 times over time. Tesla operation said the company expects to grow its EV deliveries at an average periodic rate of 50 over a multi-year horizon. In 2020, the company delivered nearly vehicles. Grounded on its anticipated growth rate, the company could be delivering 28 million buses annually 10 times from now. To be fair, extending the operation’s”multi-year” estimate to this story’s 10 times estimate is reasoning beyond what the company has said. So let’s assume that its growth slows down to a normal of 20 annually after five times. By doing so, Tesla could still be dealing roughly9.5 million EVs annually by 2030.

For perspective, that is a number close to what each of Volkswagen or Toyota Motor ended in 2020. To vend that numerous EVs, Tesla needs to first produce them. The company presently has a production capacity of roughly 1 million buses per time. It’s constructing two new Gigafactories, one in Berlin and the other in Texas. Beyond that, the company plans to launch new models including its Cybertruck, Semi, and Roadster. Tesla plans to construct at least two new Gigafactories beyond what is formerly blazoned in the coming times, though their locales aren’t yet decided. So, there’s a lot of work and growth, ahead for Tesla in the coming decade.

Crucial growth avenues

Tesla’s long-term growth will not solely be coming from dealing with EVs. The company has established itself as a disruptor, and it could continue living over to that image in the times to come. There are several other implicit growth avenues for Tesla.

First, the company is concentrated on advancing its autopilot and Full Tone-Driving (FSD) features. To attract the stylish AI gift, Tesla hosted an AI day event in August. Especially, attracting stylish gifts is crucial for Tesla to lead on the FSD front. Several automakers and technology companies are working to make independent driving a reality, and utmost has the fiscal coffers to achieve that ideal. Technological know-how could well separate the winner then. Tesla is also expanding its FSD beta testing to further motorists; that should help smooth the rollout of its FSD functionality.

Second, nonstop advancements in-vehicle software and battery packs are needed for Tesla to maintain its edge in EVs and FSD, and the company is fastening on these aspects, too. Energy storehouse and solar deployments are other implicit growth areas for Tesla; the company has been progressing well in both parts. Eventually, Tesla is fastening on bus insurance as a growth occasion. Obviously, the company plans to do this else than traditional insurance companies. Tesla plans to use its vast motorist data for effects similar as retardation, turning, unsafe following, forward collision warnings, and so on to prognosticate the probability of a collision and offer custom decoration rates grounded on that. How Tesla fares then remain to be seen.

Investor takeaway

All by each, there’s a lot to look forward to from Tesla in the coming decade and beyond. As the company progresses on these fronts, its stock could rise further from then on. The stock may not induce the outsized returns that it did in the once couple of times as a lot of growth is formerly priced in. Yet, I suppose it’s well- placed to induce request- beating returns in the coming several times.